It's been since January when the first case of coronavirus was reported in the United States and mid-March since the first stay-at-home orders were issued and understandably, our country is still reeling. As of June 4th, it was reported that 21.5 million Americans were unemployed and over 100,000 small businesses have had to close their doors. The good news is, there has been talk of new jobs being created and some businesses are reopening. Things will get better, but clients and prospects will still be looking to you for answers--

Help Make Clients Immune... with Life Insurance?

Posted by Lori Fogle on Wed, Jun 17, 2020 @ 12:00 PM

Could 'Stuffing the Tax Brackets' Help Clients in Retirement?

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Wed, Feb 19, 2020 @ 12:00 PM

I’m a creature of habit, and my Saturday morning routine always takes me to my favorite dry cleaners. The owner knows that I work in the financial services industry but made it clear on another occasion that he has an advisor already and one whom he seems to be happy with.

We’ve never talked specifically about his personal finances because I don't make a habit of talking business with folks unsolicited. I’m uncomfortable with it. On this day however, my friend asked me some questions...

Does a Delayed Strategy for Social Security Make Sense?

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Wed, Dec 11, 2019 @ 12:00 PM

There are many reasons clients might delay claiming Social Security benefits. At our firm, once we’ve cleared up common misconceptions with our clients, they’re often more open minded about hearing possible reasons for a delayed strategy. Many had never thought of these reasons before. Have you?

Tags: taxes, Social Security

Roth IRA Conversions: 5 Factors Your Clients Should Consider

Posted by Lori Fogle on Wed, Jun 19, 2019 @ 12:00 PM

To make it easier for you to share, save, or print the key factors for clients to consider when doing a Roth IRA conversion, we've created an infographic for you. Check it out below.

Help Your Clients Be Aware of RMDs and Related Taxes in Retirement

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Wed, Mar 27, 2019 @ 12:00 PM

Whether your clients file their taxes with the assistance of an online preparation service or by working with you or a tax professional, they may have been advised to contribute to a qualified plan like an IRA in order to minimize their previous year’s taxes. Where clients have allocated their resources may increase their taxes in retirement and contribute to determining their Required Minimum Distributions (RMDs).

Tags: taxes, Social Security

Tax Deduction Limitations of IRC Sec. 199A for Financial Professionals

Posted by Bill Jackson J.D. CLU on Wed, Mar 13, 2019 @ 12:00 PM

Final regulations from the Internal Revenue Service (IRS) may impact the application of pass through income deductions for financial professionals. The Tax Cuts and Jobs Act (TCJA) is one of the most sweeping tax changes in 35 years. It provided major tax benefits for financial services businesses along with lower taxes for many individuals.

Tags: taxes

Tax Cuts and Jobs Act Strategies for Financial Services Businesses

Posted by Bill Jackson J.D. CLU on Wed, Feb 20, 2019 @ 12:00 PM

Tax Cut and Jobs Act (TCJA); short for “An act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018.” What a mouthful! I think we will stick with TCJA. One of the major areas of complexity in this new law, is its application to pass through entities.

Tags: taxes, retirement strategies

3 Ways Your Clients Can Benefit from the Tax Cuts and Jobs Act

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Wed, Jan 10, 2018 @ 12:00 PM

The Tax Cuts and Jobs Act is in the books. It may be seen as a benefit to individuals as well as some business structures. It’s best to discuss with your clients how they can take advantage of the new changes.

Tags: taxes

How to Plan for a Client's Provisional Income in Retirement

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Wed, Jun 28, 2017 @ 05:47 PM

One of the most engaging topics that I cover in my Social Security education class is the impact of taxes. Most attendees at my workshops don't know that their Social Security benefits may be subject to tax. Of those few who do know, many are unsure as to how it is determined, and how much tax they are likely to pay.

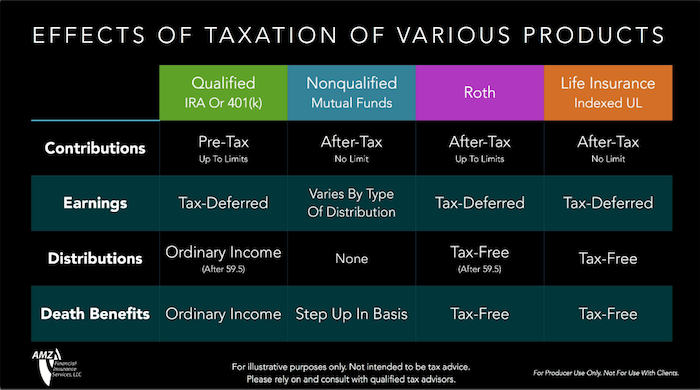

How Taxes Impact Your Clients' Different Financial Accounts

Posted by Partners Advantage on Thu, May 11, 2017 @ 05:22 PM

When choosing the best financial product for your clients, you must take the tax advantages or disadvantages into account. The way contributions, earnings, distributions, and death benefits are taxed could dramatically impact how much your clients or their beneficiaries receive when their accounts are cashed out. Here's a high level comparison of how taxes impact your clients' different financial accounts.

Tags: IUL (indexed universal life insurance), taxes, retirement strategies

FOR PRODUCER USE ONLY. NOT FOR USE WITH CLIENTS.

This content is for informational and educational purposes only and is not designed, or intended, to be applicable to any person's individual circumstances. It should not be considered as investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action.