The Tax Cuts and Jobs Act is in the books. It may be seen as a benefit to individuals as well as some business structures. It’s best to discuss with your clients how they can take advantage of the new changes.

While we can’t directly control tax law, we can know the rules and play the game in the most favorable way for your clients and their families. The following are three ways that your clients can take advantage of the new law and put it to work for them.

While we can’t directly control tax law, we can know the rules and play the game in the most favorable way for your clients and their families. The following are three ways that your clients can take advantage of the new law and put it to work for them.

1. Opportunity to Save and Pay Down Debt

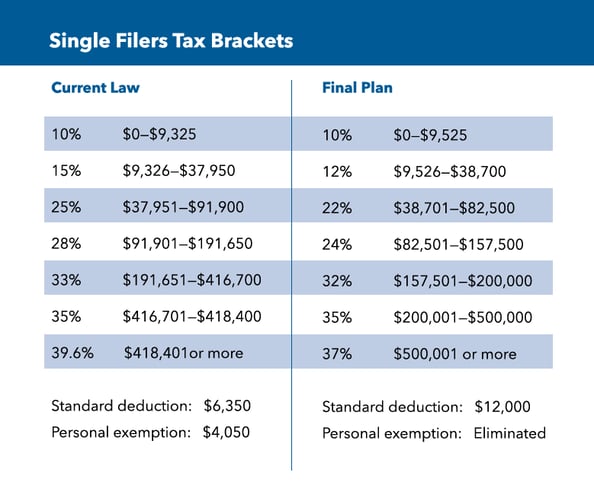

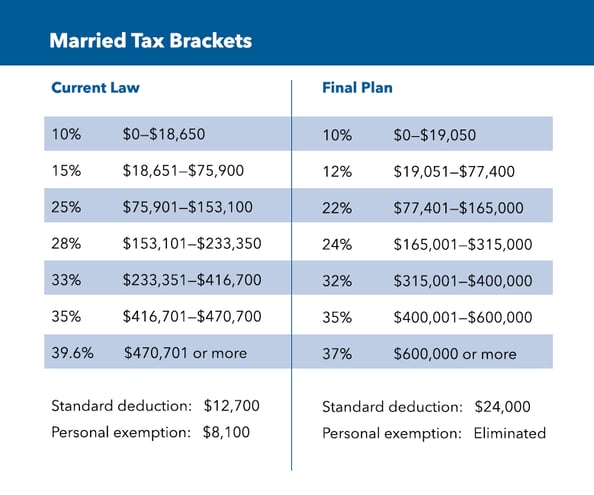

The new tax law keeps the seven progressive tax brackets from previous law rather than reducing them to 5 as was discussed early on in the debate. Although there are still 7 brackets to keep tabs on, tax percentages and the thresholds have changed. Tax percentages have decreased for both individual filers as well as married couples filing jointly. Most Americans will likely see an increase in their take-home pay.

Not only do tax rates decrease, the thresholds for crossing into higher tax brackets increase. In other words, a client can make more taxable income in 2018 than he or she could in 2017 without moving into the next higher tax bracket. This means many Americans will pay less federal income tax.

Utilize the Extra Pay

What should your clients do with the increase in take home pay? You might suggest that they pay down any bad debt. Credit cards, auto loans, and other consumer debts can wreak havoc on your clients' retirement lifestyles. They should start paying their debts down now so it doesn’t follow them to, or through, retirement.

Your clients may also consider increasing their savings contributions. It seems to be human nature to spend more as we earn more. However, if your clients are able to increase savings contributions and it doesn’t affect their current lifestyles, it may be best to put that money away for a rainy day.

2. Roth Conversions Potential

In 2018 it might be a good idea for clients to consider converting IOUs to the IRS into tax-free accounts. What are IOUs to the IRS? 401K(s), traditional IRAs, SEP IRAs, SIMPLE IRAs, 403(b)s, and many other tax deferred retirement savings accounts are yet-to-be-taxed. They are, in a sense, IOUs to the IRS. They are forever taxable accounts. The principal balance is taxable as regular income when withdrawn, the growth earned on investments in these accounts will be taxed at regular income tax rates when withdrawn, and the death benefits paid to your beneficiaries will be taxed at their income tax rates. You cannot escape the inevitable. Uncle Sam will get his cut, at yet to be determined tax rates, right when you need the money the most, in retirement.

Converting forever-taxed money to never-taxed money just became cheaper for many Americans. Lower tax rates make it less expensive to pay off the federal government’s share of retirement accounts. However, increased tax brackets have added an incentive to convert a larger portion of retirement dollars at a reduced tax rate, without crossing into the next threshold.

Convert More with Less Tax

A married couple in 2017 with an adjusted gross income of $65,000 could have converted $10,900 to their Roth IRA before crossing into a 25% tax bracket. They would have owed the federal government 15% tax on the converted amount, or $1,630. That same couple can now convert $12,400 before crossing into the 22% tax bracket and only pay 12% on the conversion, or $1,488.

Couples making more than $77,400 can convert some of their forever-taxed money at even steeper discounts than previous years. A married couple in 2017 with an adjusted gross income of $145,000 converting $10,000 would have paid a 25% tax on $8,100 ($2,025), and 28% tax on the next $1,900 ($532) for a total tax bill of $2,557 on the conversion. Now this couple could convert the same $10,000 and only pay 22% tax, or $2,200 on the entire amount. That’s nearly a 14% difference by converting under the new tax legislation.

The next higher tax bracket threshold is $165,001 at 24%, still less than the 25% tax bracket in 2017 and previous years. The 24% tax bracket runs all of the way up to $315,000. Considering that in previous years the 28% bracket ran from $153,101 to $233,350, and the 33% bracket ran from $233,351 to $416,700, the new tax law is giving higher wage earners much more latitude to convert some of their forever-taxed money to never-taxed money, at a significantly discounted tax rate.

3. Capitalizing on Market Gains

Long term capital gains occur on investments held longer than 12 months. Short term capital gains are gains on investments that are held for 12 months or less. Short-term gains are taxed as regular income while long-term capital gains rates very based on income. For example, married taxpayers filing jointly pay 0% long-term capital gains until their income exceeds $77,200. From $77,201 to $479,00 the rate is 15%, and it's 20% for income earners above that.

Avoiding Higher Tax Brackets

The market has been favorable, and it may be a good time to pocket some of the profit. If your clients' household taxable incomes are less than $77,200 they may be able to take a profit on some of their long-term investments without owing any tax in 2018. However, before deciding to take some of the gains off the top, make sure your clients understand how capital gains affects their income tax brackets. Capital gains do get added into taxable income and can push your clients into a higher tax bracket.

Help Your Clients Take Advantage

So what can you do to make a difference for your clients and their families? If your clients' paychecks increase, they could pay off bad debt faster. If their debt is paid off, perhaps they should consider contributing to a tax-free retirement income account like a Roth IRA.

If their income exceeds the contribution limits for a Roth IRA, there may still be a way to take advantage of a Roth IRA, or other tax advantaged savings plan. They could consider converting some of their forever-taxed money to a Roth IRA. It may make sense for some of their retirement dollars, while not for others.

You clients may also profit from extraordinary market gains. No one knows exactly how long the favorable market conditions will continue or what a correction might look like when it comes. It may be a good time to review their retirement plan to determine if some investments should be sold now, while someone else is willing to give top dollar for them.

To unlock the power of Indexed Universal Life (IUL) you need to be able to position the product in a way that compels the client to take action. Not only does this webinar walk through a powerful software program that can be used with clients, but it also shows you how to generate more leads by providing turn-key marketing programs, seminars, and brochures.