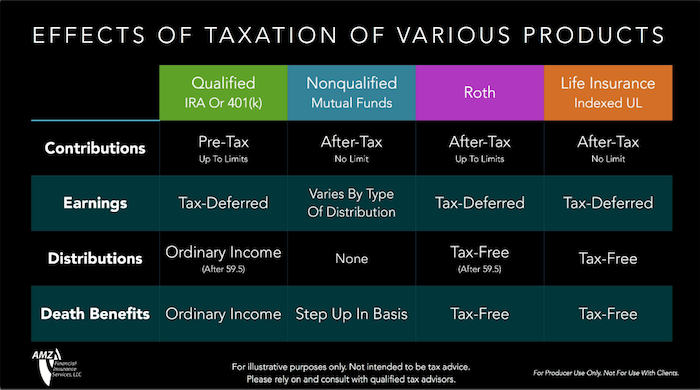

When choosing the best financial product for your clients, you must take the tax advantages or disadvantages into account. The way contributions, earnings, distributions, and death benefits are taxed could dramatically impact how much your clients or their beneficiaries receive when their accounts are cashed out. Here's a high level comparison of how taxes impact your clients' different financial accounts.

How Taxes Impact Your Clients' Different Financial Accounts

Posted by Partners Advantage on Thu, May 11, 2017 @ 05:22 PM

Tags: IUL (indexed universal life insurance), taxes, retirement strategies

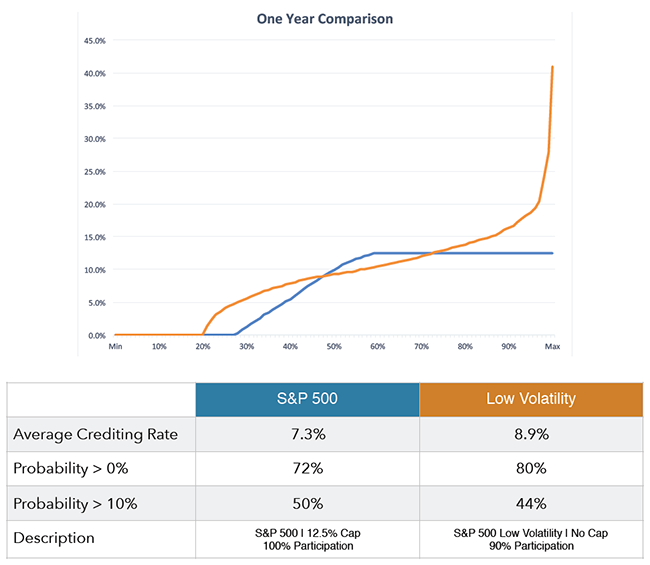

How the Long Term Performance of IUL Benefits Your Clients

Posted by Partners Advantage on Mon, Apr 17, 2017 @ 05:43 PM

A question some clients raise is that they’ve been told that indexed universal life policies won’t perform over the long term, in other words the policy performance isn’t as rosy as illustrated. Before AG 49, many producers over-illustrated the power of IUL, and today those new guidelines help temper some of the more outrageous claims. However, many carriers are finding unique ways to enhance policy performance by reducing the costs to buy the indexing options.

Tags: IUL (indexed universal life insurance), practice management

Why IUL Isn't as Expensive as Your Clients May Think

Posted by Partners Advantage on Mon, Apr 03, 2017 @ 05:37 PM

Selling indexed universal life over the phone is relatively easy if you have access to products that overcome the big objections to buying life insurance. The first objection to IUL that you’ll typically hear is that it is expensive. Here's why IUL isn't as expensive as your prospects think...

Tags: IUL (indexed universal life insurance), practice management

Why Illustrating a Switch From Death Benefit Option B to A Makes Sense

Posted by Jason Konopik on Thu, Sep 22, 2016 @ 05:17 PM

Universal Life insurance offers two death benefit options. Most financial professionals know the difference between the death benefit options. However, few understand how structuring the policy correctly can make a significant difference to long-term cash values.

Should Your Client Take Fixed or Variable Loans?

Posted by Jason Konopik on Mon, Aug 08, 2016 @ 05:07 PM

Life insurance provides valuable protection for loved ones. While the primary purpose of pure life insurance protection is to provide a death benefit, many cash-value products offer "living benefits" that you can take advantage of during your lifetime. One major living benefit of cash-value life insurance is access to the cash values in times of need, such as to help pay for a child's education or to help fund retirement.

To amplify the power of Internal Revenue Code (IRC) Section 7702 many producers wonder what is the best way to structure a life insurance policy if given the choice of using either the Cash Value Accumulation Test (CVAT) or the Guideline Premium Test (GPT). For this reason, making the proper choice -- or selecting a product with the specific test more favorable to the plan design -- is an important issue when structuring the policy. The test selected can have a significant impact on premiums, cash values and death benefits.

Impact of Words and Selling Permanent Life Insurance

Posted by Partners Advantage on Thu, Apr 07, 2016 @ 11:08 AM

Tags: IUL (indexed universal life insurance), sales techniques

With the proliferation of social media accounts, and their overall acceptance in the financial services marketplace, many producers wonder how to start the process of prospecting for IUL clients with Facebook or Twitter. It really comes down to a few key elements:

Tags: IUL (indexed universal life insurance), prospecting, retirement strategies

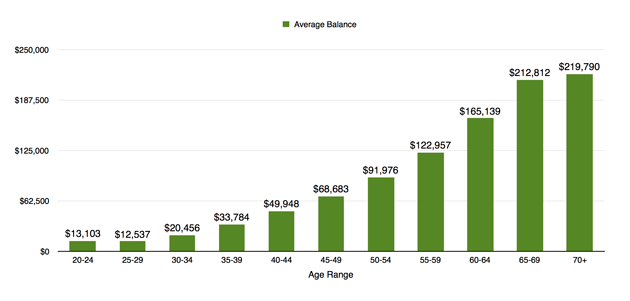

Five Things Clients Should Consider Before Saving Money For Retirement

Posted by Partners Advantage on Tue, Feb 23, 2016 @ 12:54 PM

Before we get started, let's get real. Most people aren't saving enough money for retirement. According to a 2015, Employee Benefit Research Institute study, here's the average retirement savings balance for various age groups:

Tags: IUL (indexed universal life insurance), retirement strategies

FOR PRODUCER USE ONLY. NOT FOR USE WITH CLIENTS.

This content is for informational and educational purposes only and is not designed, or intended, to be applicable to any person's individual circumstances. It should not be considered as investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action.