Universal Life insurance offers two death benefit options. Most financial professionals know the difference between the death benefit options. However, few understand how structuring the policy correctly can make a significant difference to long-term cash values.

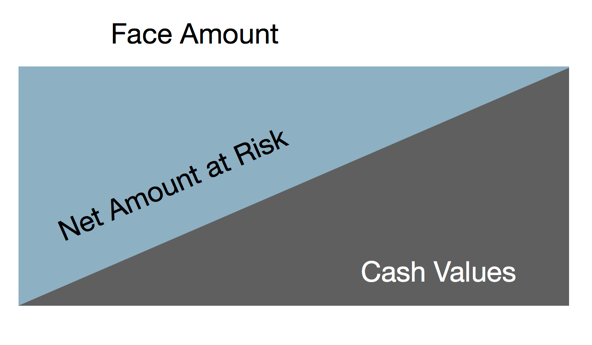

Option A - Level Death Benefit

Under this option, the policy owner specifies a face amount. As long as the cash-value remains in the cash-value corridor, the death benefit will always be equal to the face amount. Also under this option the Net Amount at Risk (the difference between the face amount and the cash value) decreases over time. See the illustration below:

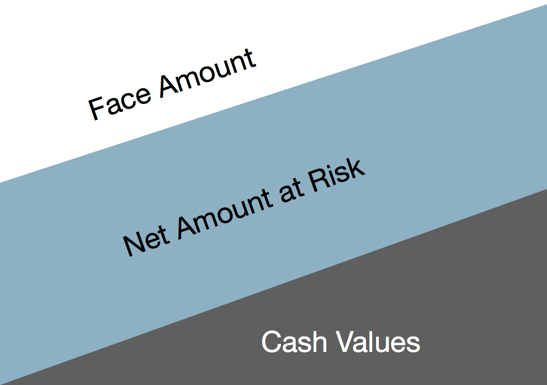

Option B - Increasing Death Benefit

Under this option, the policy owner specifies a face amount as well. However, the death benefit is always equal to the face amount plus the cash values. So as the cash values increase, the death benefit also increases. Under this option, the net amount at risk remains level. See the illustration below:

Death Benefit Focused

If you are structuring your policy primarily for a stated death benefit, you generally want to use Death Benefit Option A. This provides a higher level of initial death benefit, and if you are not focusing on funding the policy to maximize cash values, you should not have a required increase in death benefit down the road.

More Than Just Death Benefits

When structuring a life policy to provide more than just a death benefit, you should consider the death benefit option that favors higher long-term cash value accumulation.

Starting with Option B

What many smart financial professionals do to help keep policy costs low and push cash values up is to start with Death Benefit Option B during the policy's funding years. In most cases, the Internal Revenue Service (IRS) allows for a lower initial death benefit relative to premiums paid if Option B is selected initially. Generally this approach keeps the initial death benefit lower, therefore policy costs are lower. By keeping costs down during the funding years, the policy values can grow significantly faster.

Switching to Option A

Once the funding period is over, you can then switch to Death Benefit Option A, and the death benefit goes to a level amount, instead of an increasing amount. This will lead to a lower cost of insurance after the funding period. At this point your client should have a significant cash build up in the policy that they can begin to harvest tax-free through policy loans.

Before you run your next illustration, be sure to understand your client's needs so you can choose the right life insurance death benefit option that will produce the best long-term results. There are even some products available that by its inherent product design lowers costs even further.

Want to rev-up your IUL sales? This compliance-reviewed client presentation helps your prospects see the value in purchasing an IUL policy as a way to supplement their retirement. Click below to see a full preview of the IUL client presentation we provide to agents.