There are many cash-value life insurance products for clients who are focused on protecting their loved ones, wealth accumulation and tax-free distributions. The differences between these products can significantly impact the wealth accumulation potential of the policies. Let's examine the various cash-value products available and determine the top life insurance products for this purpose.

Life Insurance Products for Clients Focused on Wealth Accumulation

Posted by Partners Advantage on Wed, Feb 14, 2018 @ 12:00 PM

Tags: IUL (indexed universal life insurance), retirement strategies

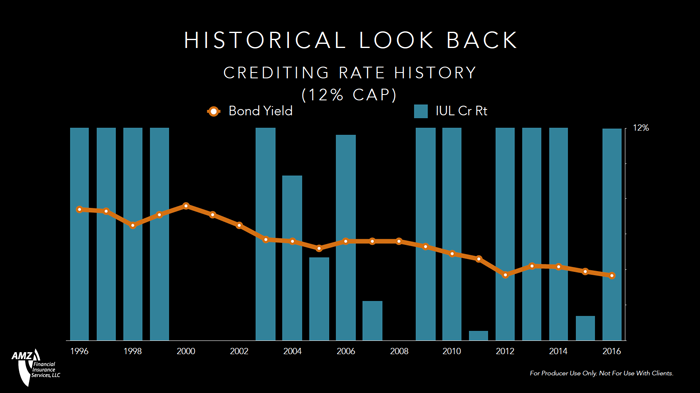

You may have seen some pretty large industry movement in decreasing cap rates at carriers, especially in regards to Indexed Universal Life insurance (IUL). It seems like this is an industry wide issue and “carrier chatter” is really heating up across the board.

How Your Clients Can Increase Future IUL Contributions

Posted by Partners Advantage on Wed, Jan 24, 2018 @ 12:00 PM

Financial professionals often look at clients solely through the eyes of an illustration. We assume what a client looks like today will continue into eternity, instead of realizing that life changes over time. One example of this has to do with clients being able to afford higher contributions to an indexed universal life insurance (IUL) policy in the future than what they can afford today.

Tags: IUL (indexed universal life insurance), retirement strategies

Until 1982 no statutory rule existed that defined the characteristics of life insurance for federal tax purposes. However, in the early 1980s, Congress was motivated to act by the development of a new generation of Universal Life contracts because these new products provided significantly more cash-value build-up than was needed to support the death benefit.

How Order of Returns Risk Can Impact Your Clients

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Wed, Nov 22, 2017 @ 12:00 PM

One of the most common risks in retirement is order of returns risk (also known as: sequence of returns risk). It is well known within the financial services industry that investing in marketable securities exposes clients to this risk. However, do your clients know that many indexed products are not immune from order of returns risk?

Tags: IUL (indexed universal life insurance), retirement strategies

Questions You Should Ask Clients to Reduce Delayed Applications

Posted by Partners Advantage on Thu, Sep 28, 2017 @ 12:00 PM

To no surprise of anyone in our business, financial professionals often express to me their frustrations with the life insurance underwriting process. When I consult with them, I find myself asking the same important questions:

Tags: IUL (indexed universal life insurance), practice management, retirement strategies

Bond Alternatives You Can Use to Strengthen Your Clients' Portfolios

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Wed, Jul 26, 2017 @ 05:42 PM

In the past, financial professionals have relied on a well-balanced portfolio of stocks and bonds to manage a client’s risk versus return. While the concept is widely accepted, if you ask 50 different financial professionals what a well-balanced portfolio of stocks and bonds looks like, you'll likely get 50 different answers.

Tags: IUL (indexed universal life insurance), annuity, retirement strategies

How IUL Policies Can Provide Your Clients More Benefits with Less Risk

Posted by Partners Advantage on Wed, Jul 19, 2017 @ 05:14 PM

There are various products out there that provide your clients with retirement income, and many of the traditional options such as a 401(k), IRA or Roth account come to mind. What many of your clients may not realize is that a properly structured and funded Indexed Universal Life (IUL) policy can provide your clients more benefits with less risk than the traditional options.

Tags: IUL (indexed universal life insurance), retirement strategies

How Your Client's Indexed Universal Life Policy Credits Interest

Posted by Jason Konopik on Thu, Jun 08, 2017 @ 05:58 PM

A very basic way to understand how Indexed Universal Life (IUL) credits interest is to think of it like a very simple game where you flip a coin 10 times. There are then two ways to play the game. In Game 1 you win $100 for every head, and lose $100 for every tail. Game 2 awards you $70 for every head, but you lose nothing for every tail.

Tags: IUL (indexed universal life insurance), retirement strategies

Why IUL Works for Your Clients Today and Tomorrow

Posted by Partners Advantage on Tue, May 23, 2017 @ 05:05 PM

Today with so many carriers and marketing organizations jumping on the Indexed Universal Life (IUL) bandwagon, it’s hard to believe that the product was actually introduced to the market in 1997. Back then, forward-looking insurance companies were trying to find ways to make their fixed insurance products more attractive.

Tags: IUL (indexed universal life insurance), retirement strategies

FOR PRODUCER USE ONLY. NOT FOR USE WITH CLIENTS.

This content is for informational and educational purposes only and is not designed, or intended, to be applicable to any person's individual circumstances. It should not be considered as investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action.