Spring has sprung and summer is on its way! This time of year makes many want to get their golf clubs out and hit the golf course. As you may know, golf can become addicting no matter how great or how “not so great” your game may be. As a financial professional you probably find little time to enjoy a golf game, and would love the opportunity to be on the course a little more often. Have you thought of using golf as a client appreciation event? The truth is that if you don’t appreciate your clients, someone else will.

Golf Outings: A Financial Services Tool for Client Appreciation

Posted by Partners Advantage on Tue, Jun 13, 2017 @ 12:35 PM

Tags: prospecting, marketing for independent agents, retirement strategies

How Your Client's Indexed Universal Life Policy Credits Interest

Posted by Jason Konopik on Thu, Jun 08, 2017 @ 05:58 PM

A very basic way to understand how Indexed Universal Life (IUL) credits interest is to think of it like a very simple game where you flip a coin 10 times. There are then two ways to play the game. In Game 1 you win $100 for every head, and lose $100 for every tail. Game 2 awards you $70 for every head, but you lose nothing for every tail.

Tags: IUL (indexed universal life insurance), retirement strategies

5 Important Details to Consider When Helping Clients Plan for Retirement

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Tue, Jun 06, 2017 @ 05:11 PM

Every client has different goals and resources as they prepare for retirement. There are five important details to consider when working with clients. These are not the only necessary details required for helping clients plan for retirement, but they should not be overlooked.

Tags: coaching, retirement strategies

Is It Time to Retire the "Rule of 100" and One-Size-Fits-All Plans?

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Thu, May 25, 2017 @ 05:43 PM

A basic principle of investing is that you should gradually reduce your exposure to risk as you get older. Generally speaking, a younger investor has a longer time horizon and therefore can absorb more short-term investment risk. An older investor has a shorter time horizon and therefore doesn’t have as much time to absorb short-term investment risk.

Tags: coaching, retirement strategies

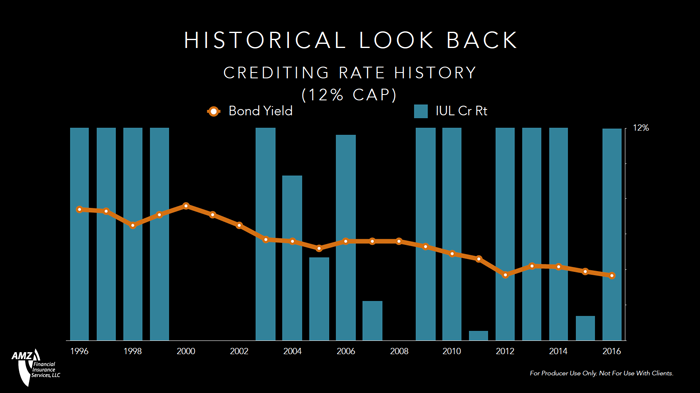

Why IUL Works for Your Clients Today and Tomorrow

Posted by Partners Advantage on Tue, May 23, 2017 @ 05:05 PM

Today with so many carriers and marketing organizations jumping on the Indexed Universal Life (IUL) bandwagon, it’s hard to believe that the product was actually introduced to the market in 1997. Back then, forward-looking insurance companies were trying to find ways to make their fixed insurance products more attractive.

Tags: IUL (indexed universal life insurance), retirement strategies

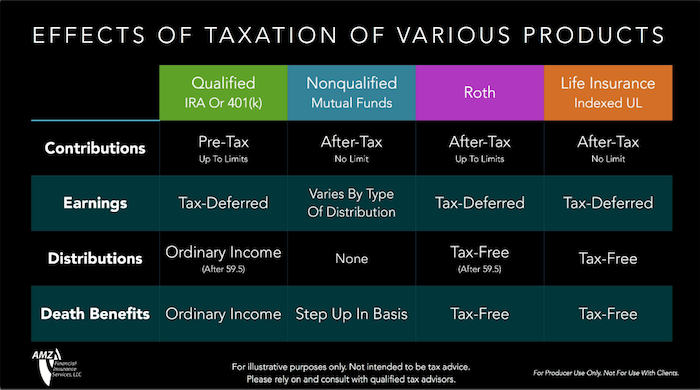

How Taxes Impact Your Clients' Different Financial Accounts

Posted by Partners Advantage on Thu, May 11, 2017 @ 05:22 PM

When choosing the best financial product for your clients, you must take the tax advantages or disadvantages into account. The way contributions, earnings, distributions, and death benefits are taxed could dramatically impact how much your clients or their beneficiaries receive when their accounts are cashed out. Here's a high level comparison of how taxes impact your clients' different financial accounts.

Tags: IUL (indexed universal life insurance), taxes, retirement strategies

What You Should Know Before Requesting an Illustration

Posted by Partners Advantage on Tue, May 09, 2017 @ 05:01 PM

Case design and illustration requests are common daily events that Independent Marketing Organizations (IMOs) handle for advisors they work with. Many of the advisors we work with do a great job of fact finding during the first meeting with a client. Getting the facts and details up-front are extremely important for putting together a good, strong recommendation that can be presented during your next meeting.

Tags: coaching, retirement strategies

Do Your Clients See You as a Financial Supplier or an Architect?

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Thu, Apr 27, 2017 @ 05:52 PM

Are you a financial services supplier or an architect? Your clients may be viewing you as one or the other. When it comes to building homes (or financial plans) the raw material supplier and the architect both play a significant role in the construction of a home. Neither is necessarily bad or good, better or worse. They have very different roles to play, and they have very different perspectives.

Tags: prospecting, coaching, retirement strategies

Every Financial Plan Needs a Solid Foundation

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Wed, Apr 19, 2017 @ 05:29 PM

Every home needs a solid foundation. The same holds true for financial plans. When it comes to constructing a new home, one of the first crews on sight is the excavation team. They dig and lay the foundation. The foundation determines the long-term stability of the home to be built on top of it.

Tags: coaching, retirement strategies

Do Your Clients Have Lazy Money?

Posted by Mark Triplett, CEO of Triplett-Westendorf Financial Group on Tue, Feb 14, 2017 @ 05:19 PM

When it comes to wealth management, your client's money can do two things: It can earn interest or buy stuff. The problem is that many clients have "lazy money" just sitting around waiting to be spent. Money gets "lazy" when it is not being used to do one of the two things it can do with respect to wealth management.

Tags: retirement strategies

FOR PRODUCER USE ONLY. NOT FOR USE WITH CLIENTS.

This content is for informational and educational purposes only and is not designed, or intended, to be applicable to any person's individual circumstances. It should not be considered as investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action.