Last updated March 2020

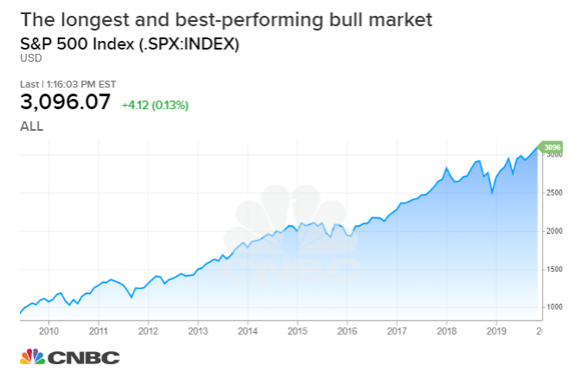

After a long run in a bull market, recent market corrections and talk of an economic slowdown can mean scary times for your clients. Are you prepared with strategies that could save them from potentially losing retirement savings?

Financial professionals can point to a history of market corrections after long-running bull markets and uncertain market conditions when helping their clients choose a retirement strategy that may include fixed indexed annuities with guaranteed lifetime income riders.

Granted, this isn’t always an easy conversation because you have clients who’ve been “riding the bull” for a while now.

Source: Li, Yun. This is now the best bull market ever. CNBC, Nov 14 2019. https://www.cnbc.com/2019/11/14/the-markets-10-year-run-became-the-best-bull-market-ever-this-month.html. Accessed Mar 10 2020.

However, clients may want to be prepared for the possibility of lower returns on the horizon (not panicked but prepared) -- the recent dips in the market due to the coronavirus may have awakened clients to a grimmer reality. If directly invested in the market, situations like this could result in a loss of retirement resources impacting their future lifestyle.

So, where do you direct your clients— especially those hesitant to give up on the higher returns the market has offered in recent years?

Start a conversation with your client

Reconfirm how much they NEED in order to prepare for the retirement lifestyle they desire and then possibly guide them to options that could protect that balance through product guarantees backed by the financial strength of the insurer.

If they want to leave some in the market, fine. But if they leave it all, they might need a brief history lesson reminding them of the precarious territory we’re in.

Hop in that time machine and take them back with these stats.

- "The stock market crash of Oct. 29, 1929, marked the start of the Great Depression and sparked America's most famous bear market. The S&P 500 fell 86 percent in less than three years and did not regain its previous peak until 1954"2.

- Between June 1932-33, the S&P sees a growth of 177%, which was followed by a correction that resulted in a 34% loss1.

- "Less than a year after the end of World War II, stock prices peaked and began a long slide. As the postwar surge in demand tapered off and Americans poured their money into savings, the economy tipped into a sharp 'inventory recession' in 1948."2

- Fast forward to 1990-2000, where we experienced the greatest bull market in history with the S&P seeing an increase of 320%1.

- The dot.com bubble burst in March of 2000 and the market dropped nearly 50% in one month2.

- Fairly fresh in everyone’s minds the heart of the financial crisis in 2008 when "the market had fallen to its lowest levels since 1997."2

Be upfront with those in retirement or close to it

"You have to ask your clients: Will your retirement portfolio survive when the bull market turns bear?" says National Vice President, Oscar Toledo.

Point out the realities of the market and other opportunities that are available to them and make it resonate with clients by clarifying your message around these market cycles.

How do you do that?

- Ask them if they can afford to lose the wealth they’ve accumulated. Paint a picture of what happens if they do experience a loss in the market. Is it having to go back to work after they retired from their full-time career? Is it searching for a company that will hire them? Is it health problems that crop up due to stress? Is it family relations and retirement lifestyle that suffer?

- Explain that the interest rate environment is low. And doing a 180 and putting their money into a fixed interest product may slow down the progress towards their retirement goals.

- Point out the inverse relationship of the bond rates to the interest rates. If interest rates go up and they have money in bonds, those rates will be going down.

- Remind them of the guaranteed income they need to have the type of retirement they envision.

Discuss product options like fixed indexed annuities

If your clients are unsettled about the thought of their portfolio value taking a hit— introduce options that speak to their concerns as well as their goals. There are many carriers we work with that offer fixed indexed annuities with guaranteed lifetime income riders that include a chronic illness benefit.

The fixed indexed annuity*, designed to meet the long-term needs for retirement income, can receive credited interest that's index-linked and they offer guarantees against the loss of premium and that credited interest. The popularity of these products has gone up every year and has been breaking records in most recent years.

InsuranceNewsNet reported that "in 2019, fixed annuities represented 58% of the total annuity market. Although fixed annuity sales dropped in the fourth quarter (down 18% to $30.8 billion), robust sales in the first half of 2019 boosted annual fixed annuity sales to exceed its previous sales record of $133.5 billion.

In 2019, total fixed sales were $139.8 billion, up 5% from prior year.

'Much of the overall growth in the fixed market can be attributed to the continued growth in the fixed indexed annuity market,' Giesing said. 'FIA sales have increased 11 of the past 12 years, accounting for more than half of the fixed annuity market sales.'

For the year, FIA sales were $73.5 billion, up 6% from 2018 results. This surpasses the sales record for FIA sales set in 2018."

With a fixed indexed annuity, not only can clients preserve savings they’ve acquired, but they’re also able to plan for unforeseen circumstances, like needing home health care with the help of chronic illness "doublers" that some riders on fixed indexed annuities offer.

Knowing they have the specific amount they need already set aside can do a lot to calm uncertainty in tumultuous times.

Toledo says, "With the future performance of the stock market unknown, these insurance products give us an opportunity to provide clients guaranteed, predictable income for the rest of their lives."

Interested in finding out more about fixed indexed annuities with benefits that could add stability to your clients’ portfolios? Schedule a 15-minute call with a member of the Partners Advantage team today.