A question some clients raise is that they’ve been told that indexed universal life policies won’t perform over the long term, in other words the policy performance isn’t as rosy as illustrated. Before AG 49, many producers over-illustrated the power of IUL, and today those new guidelines help temper some of the more outrageous claims. However, many carriers are finding unique ways to enhance policy performance by reducing the costs to buy the indexing options.

Market Volatility Increased Costs

For years, IUL has almost exclusively offered a 1-year point-to-point crediting method with 100% participation up to a cap. However, the sustained low interest rate environment, and high market volatility has made those options very expensive, and therefore caps have steadily decreased over the years. What many insurance producers don’t realize is that the cost to buy the option is tied to the overall volatility of the option. In other words, if the option is volatile the costs are high, meaning a lower cap.

Benefits of Low-Volatility

Moving to a low-volatility option can make a lot of sense and perform very strongly over the same time period. The S&P 500 Low Volatility option makes the options cost more affordable for the carrier and this is allowing some to have uncapped performance over a one-year period. The back-casted results look amazing.

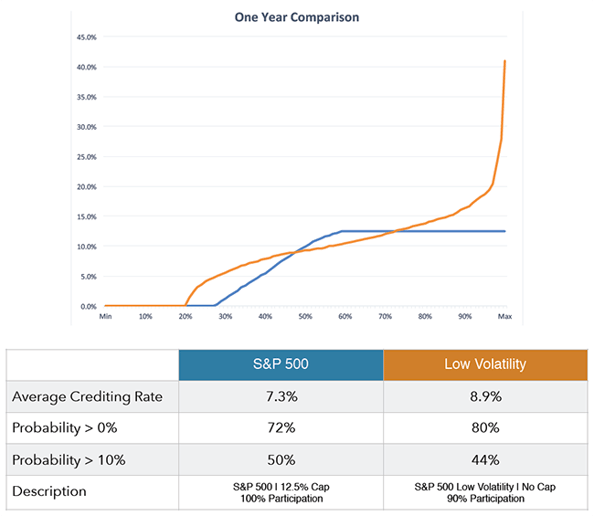

What this chart depicts are the annual crediting rates for every business day over the past 10 years. And with the low volatility option you can see that in just 20% of the results clients would have earned 0% compared to 28% of the the time with a traditional crediting option. And it makes sense, when you look at the least volatile companies, the reasons that they are considered “low volatility” is that they don’t make big gambles or take unnecessary business risks.

By carving out those companies from the overall market you can see that not only does your client get more opportunities to earn a positive return, that in close to 20% of the cases they earn more than 15%. You’d have to admit that in the previous 10-year period the market has seen its share of ups and downs and how happy your clients would be with an 8.9% average crediting rate. We all know that past performance is no guarantee of future results, but if an index option can perform in the market we just experienced, just imagine what it can do in the future.

Clients Want Guaranteed Income

For years IUL illustrations were simply numbers written on paper showing projected future values and possible loan amounts. That’s fine, but with so much focus on annuity products and the guaranteed income they provide for retirement, the life insurance carriers are starting to move in that direction. Today, insurance companies are introducing guaranteed lifetime income from an IUL policy, so that the cash-value that is in the policy can be paid out, guaranteed to age 100. Now that’s a game-changer for a client who purchased an IUL originally to protect their family, but now that they’ve grown they are ready to harvest income. They can efficiently access their cash values and receive a guaranteed retirement income.

Many advisors struggle with getting in front of the right target market that can benefit from the long term performance of IUL. Download this valuable e-book "The Five Keys to Selling IUL Virtually" and you'll discover a better way to prospect and grow your business.